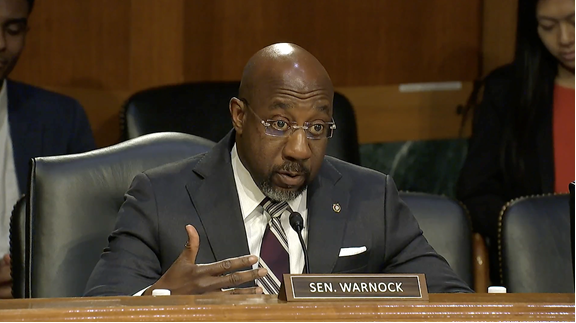

During a Tuesday Senate Agriculture Committee hearing, Senator Reverend Warnock questioned Brian Quintenz, the nominee to be Commissioner of the Commodity Futures Trading Commission (CFTC)

Senator Warnock also used the hearing to highlight the unlawful firings of Democratic commissioners by President Trump from commissions and boards across the federal government.

Senator Reverend Warnock: “This is a bad precedent set by President Trump, and I’m worried that it imperils the actual independence of many crucial regulators, including the CFTC. Americans need to know that these agencies work regardless of who the President is, and I think there’s a certain kind of credibility that comes with this kind of bipartisan spirit in the work”

Watch Senator Warnock at Tuesday’s Agriculture, Nutrition, and Forestry Committee HERE

Washington, D.C. – Yesterday, U.S. Senator Reverend Raphael Warnock (D-GA) pressed Brian Quintenz, the nominee to be Chair of the Commodity Futures Trading Commission (CFTC), about the illegal firings of Democratic commissioners. During the Senate Agriculture Committee hearing, the Senator pressed Quintenz on his willingness to protect oversight and prevent partisanship from consuming the CFTC.

“This is a bad precedent set by President Trump, and I’m worried that it imperils the actual independence of many crucial regulators, including the CFTC,” said Senator Warnock. “Americans need to know that these agencies work regardless of who the President is, and I think there’s a certain kind of credibility that comes with this kind of bipartisan spirit in the work.”

Senator Warnock also addressed the importance of maintaining the independence of key federal regulators.

“I think that the erosion of the independence of key regulators like the FTC and the NCUA is alarming, so it’s a very serious point I’m really trying to make as we have this conversation, and I hope you know you’ll hear the spirit with which I’m trying to make these points, because our markets are counting on it. Our consumers are counting on it.” Senator Warnock said.

Watch the Senator’s full remarks and line of questioning HERE.

See below a full transcript of the exchanges between Senator Warnock and the CFTC nominees:

Senator Reverend Warnock (SRW): “Congratulations, Mr. Quintenz, on your nomination. Congratulations, not only to you, but to your family. In March, President Trump violated the law by firing the two democratic commissioners at the Federal Trade Commission without cause. Then in April, President Trump ignored the law again and fired the two democratic board members at the National Credit Union Administration, again without cause. These seats remain vacant, and there will soon be more democratic vacancies at the FDIC, the Securities and Exchange Commission, and the CFTC. The commission, of course, you’ve been nominated to chair. Is it correct that you were originally nominated by President Obama?”

Brian Quintenz (BQ): “Yes, Senator. I was nominated twice previously by President Obama and by President Trump.”

(SRW): “So a Democratic president initially nominated you to fill a Republican seat on the commission. Is that correct?”

(BQ): “That’s correct.”

(SRW): “During your term as a commissioner at the CFTC, can you think of an example of any business before the commission that was improved by having both democratic and republican members at the table?”

(BQ): “Thank you, Senator. In response to another question, I can only speak to the people and the environment in which I had served previously. I had a very, very strong relationship with my fellow Commissioners and both of the chairs under which I served, very cordial. I count them all as dear friends. Now, a number of occasions we disagreed, but on some occasions we did agree.”

(SRW): “Do you think that disagreement is helpful and healthy? Do you think there’s some benefit to having a bipartisan board?”

(BQ): “I think there, I think there can be. I mean, I thought I was right.”

(SRW): “You embody, in some ways, the trajectory of your work on this commission, nominated by Democratic President, filled Republican seat. I think democratic boards play an important role. And I think that the friction in points of view, is helpful. Would you agree with that?”

(BQ): “Again, I think it can be Senator, sure.”

(SRW): “I’ll accept that it can be. This is a I think this is a bad precedent set by President Trump, and I’m worried that it imperils the actual independence of many crucial regulators, including the CFTC. Americans need to know that these agencies work, regardless of who the president is, and I think there’s a certain kind of credibility that comes with this kind of bipartisan spirit in the work. The CFTC currently has three vacancies. Do you support President Trump, nominating a full CFTC, including democratic commissioners.”

(BQ): “Thank you, Senator, the President is the chief executive.”

(SRW): “I think it’s pretty simple question, do you support that’s really a yes or no question. Do you support President Trump, nominating a full CFTC, including democratic commission?”

(BQ): “I would pledge to you to have tried to emulate the same environment of the commission. Should I have the honor be confirmed that I got to experience when I was there with whoever is serving with.”

(SRW): “I think I asked you a pretty easy question. If confirmed, will you advocate to the White House for the President to nominate and the Senate to confirm both majority and minority commissioners to the CFTC?”

(BQ): “Thank you, Senator with respect, the President is the chief executive, and he can make that decision with the advice and consent of Congress. I understand he makes a decision.”

(SRW): “Would you advocate for it?”

(BQ): “I don’t tell the President what to do.”

(SRW): “If the President continues to ignore precedent and the law and never nominates a Democratic member of the commissioner of the Commission which ignores precedent, it ignores the law. You will be the chair of the CFTC. You’ll get confirmed. So how will you as chair work to moderate then the CFTC and incorporate dissenting and minority viewpoints in the Commission’s decisions?”

(BQ): “Thank you, Senator. With respect, I don’t want to speak to all the different kinds of hypothetical environments that the Commission may experience, but I would pledge that one of the core attributes of the Administrative Procedures Act is to put out any kind of rules and notices for public comment responses to public comment need to be incorporated in any kind of final commission action. There is a wide opportunity for dissenting views in the public comment process. I would seek to receive comment from as wide of sources as possible, and I would pledge to work with you and your colleagues have a very transparent approach to my chairmanship should I have the honor of being confirmed.”

(SRW): “Do you think Democrats ever get it right? Do Republicans ever get it wrong? Do Republicans ever get it right?”

(BQ): “No one has a monopoly on the best ideas.”

(SRW): “I think that the erosion of the independence of key regulators like the FTC and the NCUA is alarming, so it’s a very serious point I’m really trying to make is we have this conversation, and I hope you know you’ll hear the spirit with which I’m trying to make these points, because our markets are counting on it. Our consumers are counting on it. These agencies protect us from the worst things that could happen. So, these political purges, because that’s what we’re witnessing, these political purges have weakened the regulators and undermined their independence, and I’m worried that the CFTC will follow suit if the important tradition of a bipartisan board goes away.”

“If confirmed, you will have the responsibility, sir, to preserve the bipartisan spirit of moderation at the CFTC, proactively pulling in minority voices whether or not President Trump follows the law.”

“And so, I look forward to holding you accountable for that responsibility if you are confirmed. Thank you so much.”

###