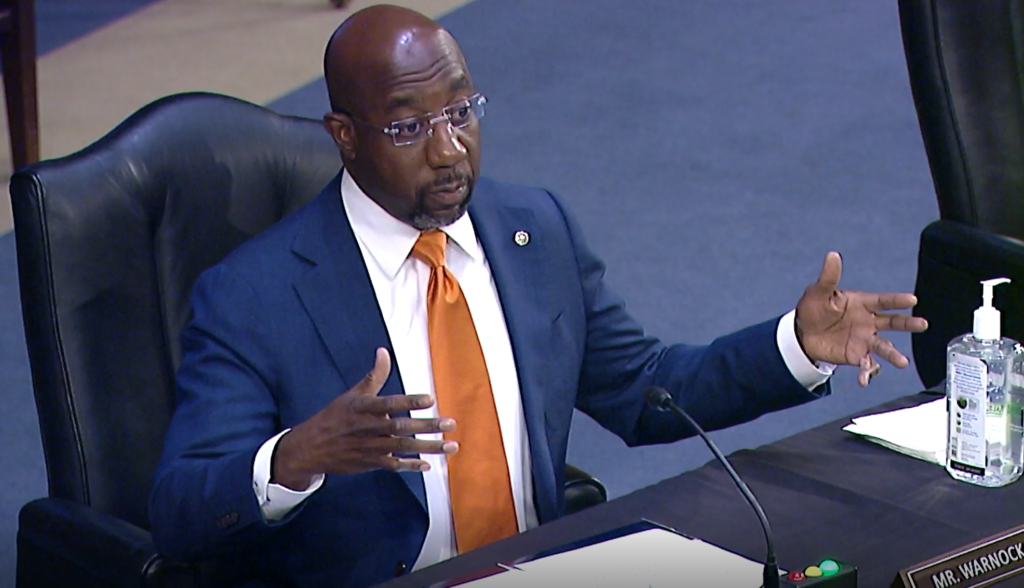

At Banking Committee hearing, Senator Reverend Warnock questioned Treasury Secretary Janet Yellen about long term benefits to families, the economy, if expanded Child Tax Credit is made permanent

Senator Warnock extolled the benefits of the expanded Child Tax Credit, noting its role in slashing poverty in Georgia and across the nation

Senator Reverend Warnock: “What we’re talking about here with the Child Tax Credit, is a tax cut. And that doesn’t get said often enough. I think it has something perhaps to do with a kind of attitude about working people, ordinary people, poor people. That’s what this is – it’s a tax cut. And experts say that this tax cut would cut child poverty in half nationwide, and 97% of families with children qualify”

ICYMI from CNBC: “The child tax credit encourages parents to work, study finds”

Watch Senator Reverend Warnock’s exchange HERE

Washington, D.C. – Today, during a Banking Committee hearing on the importance of addressing equity in the U.S.’s pandemic recovery, U.S. Senator Reverend Raphael Warnock (D-GA) emphasized his commitment to making sure Georgia’s families and small businesses have the federal support they need to stay economically strong during the on-going COVID-19 public health emergency.

During his questioning of hearing witnesses Treasury Secretary Janet Yellen and Federal Reserve Bank Chairman Jerome Powell, Senator Warnock inquired about potential conflicts of interest at the Federal Reserve, and reaffirmed his commitment to working to make the expanded Child Tax Credit permanent —underscoring the important benefits that more than 2 million Georgia children have received as their families have worked to recover from the economic perils of the COVID-19 pandemic.

In Georgia, 2,101,000 children qualified for advance CTC payments in August, according to data from the Treasury Department. According to that same data, Georgia households in the state received 1,267,000 payments, totaling $536.6 million, and the average payment per household was $424.

Watch video HERE and see below a transcript of Senator Warnock’s exchange with Secretary Yellen regarding the importance of making the expanded Child Tax Credit permanent:

Senator Warnock: I’m a strong advocate for working and middle class families. And we successfully pushed to include an expansion of the vital Child Tax Credit program in the American Rescue Plan. I think it’s really important as some folks are talking about this $3.5 trillion package, that what we’re talking about here with the Child Tax Credit, is a tax cut. And that doesn’t get said often enough. I think it has something perhaps to do with a kind of attitude about working people, ordinary people, poor people. That’s what this is – it’s a tax cut. And experts say that this tax cut would cut child poverty in half nationwide, and 97% of families with children qualify. So this is about lifting the burden of our neighbors. If made permanent, this tax cut for families would push poverty in a typical year down below 10% in 47 states, including Georgia. Secretary Yellen, should Congress make this program permanent? And if so, what kind of long term benefits will this have for our nation’s economy and families?

Secretary Yellen: Well, we certainly would like to find a way to make it permanent. It’s a very important support for children and their families. We saw just after one payment, that the share of families reporting that there wasn’t enough to eat in the household dropped by 24%. And it’s clear that families are spending this on their children, for clothing for food, and, you know, the security that our children have with it – they grow up insecure in families that don’t have enough to provide for them – make all the difference to their success in life. So this program that will provide a steady source of income, along with other supports in the sort of Build Back Better agenda, including two years of preschool, childcare support, I think these are critical investments to make sure that families with children can support them and they can succeed in their lives.

Senator Warnock: You said they use the money to buy things like food, I believe you said clothing. What in your estimation is the impact of that on the economy – in a consumer economy? Does that help or hurt?

Secretary Yellen: Well, it’s of course, it’s positive. It’s support spending in the economy that creates jobs in the process.

Senator Warnock: And what would be the impact of adding mandatory work requirements if we extend this and made it permanent?

Secretary Yellen: Well, we wouldn’t be in favor of mandatory work requirements. The truth is that the vast majority – over 90% of families that receive this assistance – are working and you have in addition, grandparents, for example, who are no longer in the workforce or people who are disabled, may not be working and can’t work. We’re also getting the support that they need to take care of children.

***Watch video of Senator Reverend Warnock’s exchange HERE***

###