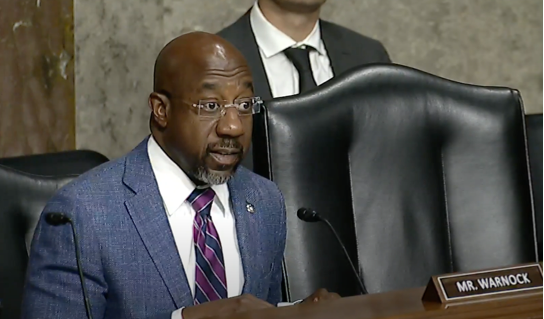

At today’s Senate Banking Committee hearing, Senator Reverend Warnock pressed former Silicon Valley Bank (SVB) CEO Gregory Becker about his role in the bank’s historic failure

Senator Warnock questioned Mr. Becker about his oversight of SVB’s failures and their ramifications

Senator Reverend Warnock also pushed Mr. Becker to answer for his nearly $10 million annual compensation from the failed institution

Senator Reverend Warnock: “In the wake of your failure, do you think it’s right for you to keep that money?”

Washington, D.C. – Today, during a hearing of the U.S Senate Banking Committee focused on the failures of Silicon Valley Bank (SVB) and Signature Bank, U.S. Senator Reverend Raphael Warnock (D-GA) pressed Gregory Becker, the former CEO of SVB, on whether or not Mr. Becker was aware of the ramifications of SVB’s failures. Senator Warnock also pushed Mr. Becker if he thought it was right for him to receive his nearly $10 million bonus in the wake of SVB’s failure.

“Hardworking families it seems to me shouldn’t have to bail out the bankers—or any executive of any company—who made risky and unnecessary bets that failed,” said Senator Reverend Warnock. Later, he continued to Mr. Becker: “In the wake of your failure, do you think it’s right for you to keep that money?”

As Chair of the Banking Subcommittee on Financial Institutions and Consumer Protection, Senator Warnock has been closely tracking the fallout from these bank failures, advocating to ensure working-class Americans were protected in the aftermath and that bank executives and regulators are properly held accountable. In March, Senator Warnock pushed the Chair of the Federal Deposit Insurance Corporation (FDIC) to ensure former SVB executives were held to account at a Banking Committee hearing focused on recent bank failures. Senator Warnock has also urged regulators to set a temporary moratorium on overdraft and nonsufficient fund fees, and urged the CEOs of the ten retail banks generating the most revenue from these fees to waive them for their customers in the wake of the failures of SVB and Signature Bank, which led to disruptions across the financial sector.

Senator Warnock has long pushed to lower bank fees for Georgians. In October 2022, Senator Warnock’s work to curb predatory bank fees gained significant momentum following the Consumer Financial Protection Bureau’s (CFPB) announcement that the agency would take steps to protect Georgians from junk fees, including surprise overdraft fees. And, in September 2022, Senator Warnock led the effort to push Wells Fargo, JPMorgan Chase & Co., U.S. Bancorp, and the PNC Financial Services Group to eliminate onerous and confusing overdraft fees. In May 2022, Senator Warnock, in his role as chair of the Senate Banking Subcommittee on Financial Institutions and Consumer Protection, held a hearing focused on the impacts of overdraft fees.

See below key excerpts from Senator Warnock’s line of questions during the Banking Committee hearing:

“Back during the 2008 crisis, we all remember that many of the bankers who got us into that mess kept their cushy salaries while families across the country lost their jobs, lost their homes, lost everything.”

“I continue to serve my church and work with communities where the poor and the marginalized — middle class families — are held to standards higher than this. They miss a single payment, and they are slammed with overdraft fees — something I’ve addressed time and time again on this committee — or they have threats of having their car repossessed, their lives turned upside down missing one payment. Hardworking families it seems to me shouldn’t have to bail out the bankers—or any executive of any company—who made risky and unnecessary bets that failed.”

“Yes or no, did you consider the consequences of your decisions on the wider financial system? The number of uninsured deposits you had at your bank; the issues that have already been raised here. Did you consider the consequences of your decisions for these ordinary folks that I’m talking about back in Georgia who would lose their home, lose everything, or much smaller lapses, who were just trying to hold it together? They don’t have the high-class problem of $10 million over a few years. Did you consider them when you were making your decisions?”

“In the wake of your failure, do you think it’s right for you to keep that money?”

“As we think about this, and what we got to do going forward, we’ve got to center the concerns of ordinary people. People who are just trying to make it — like most Americans, most Georgians— from paycheck to paycheck. Those are the folks I’ll be thinking about as we think about what we need to do moving forward.”

###