Senator Reverend Warnock, joined by a group of Democratic colleagues, introduced legislation that would support Georgia’s working families and reduce child poverty

The Working Families Tax Relief Act would make the expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit that Georgians saw in 2021 and 2022 become permanent, benefitting over 2 million Georgia children and 500,000 workers

Senator Reverend Warnock: “I am proud to join my colleagues in introducing the Working Families Tax Relief Act, which would make these smart family-focused policies permanent by centering the people who matter the most in our federal policy”

Washington, D.C. — Today, U.S. Senator Reverend Raphael Warnock (D-GA) announced the introduction of the Working Families Tax Relief Act, legislation that would cut taxes for workers and families by expanding the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC). EITC and CTC are two of the most effective tools Congress has to put money in the pockets of working people, help them keep up with the rising cost of living, and pull children out of poverty. Along with Senator Warnock, Senators Sherrod Brown (D-OH), Michael Bennet (D-CO), Cory Booker (D-NJ), Ron Wyden (D-OR), and Dick Durbin (D-IL) led the reintroduction of the Working Families Tax Relief Act. At a time when costs are higher than ever for parents and wages have failed to keep up with corporate profits, expanding the EITC and CTC will give millions more Americans a foothold in the middle class and allow parents’ hard work to better pay off.

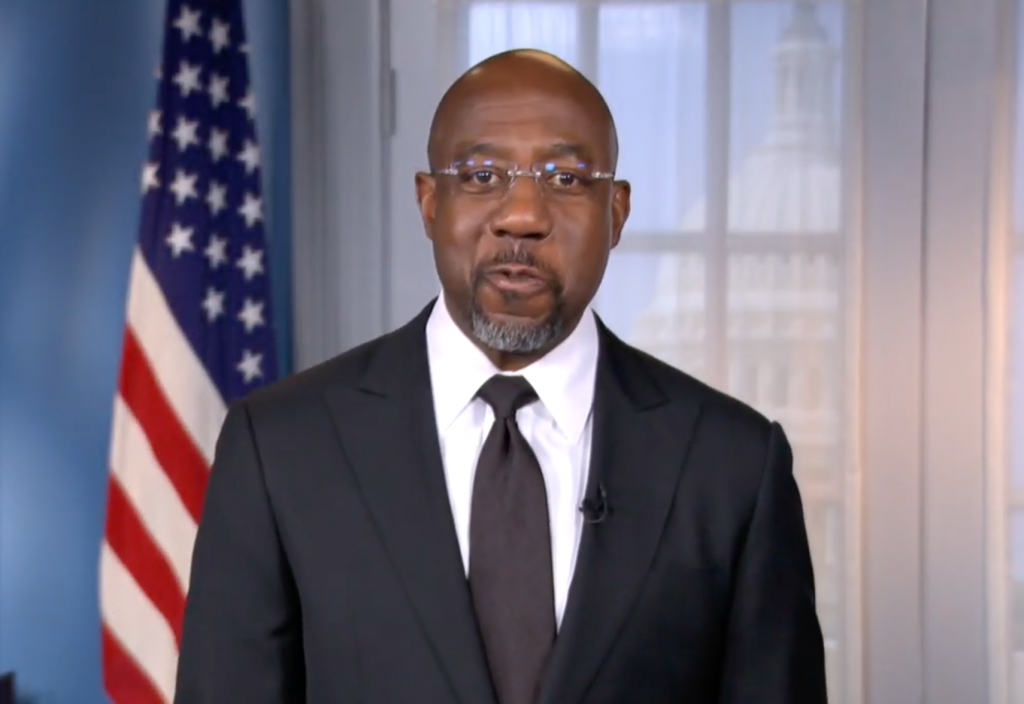

“I often say that public policy is a letter, a letter we write to our children,” said Senator Reverend Raphael Warnock in a video introducing the bill. “And when we cut childhood poverty, nearly in half, through the Expanded Child Tax Credit and Earned Income and Child Tax Credit programs included in the American Rescue Plan, we were investing in a better future for the next generation. These tax cuts — because to be very clear that’s what it is: it’s a tax cut — these tax cuts for the middle class boosted our economy and provided comfort and opportunity to the families of more than 2 million Georgia kids, which is why I am proud to join my colleagues in introducing the Working Families Tax Relief Act, which would make these smart family-focused policies permanent by centering the people who matter the most in our federal policy. Let’s get this done for Georgia families.”

The Working Families Tax Relief Act would:

- Boost the incomes of 40 million households, including 65 million children.

- Increase the CTC to $3,000 for kids 6-17 and $3,600 for kids 0-5 – when parents need it most – and make the credit fully refundable.

- Deliver the CTC monthly, providing a reliable source of financial stability so families can better keep up with the cost of living.

- Nearly triple the EITC for workers without children and make the credit available for people starting at age 19 and eliminating the maximum age. Currently, workers without children can be taxed into poverty. Expanding the EITC would fix that.

- Make permanent the American Rescue Plan’s expansion of the Earned Income Tax Credit and Child Tax Credit, which cut child poverty by 40 percent.

Senator Warnock is a steadfast champion of working families and legislation that seeks to reduce child poverty. Senator Warnock fought to secure the Expanded Child Tax Credit as part of the American Rescue Plan. Building on that work, Senator Warnock has advocated to make the Expanded CTC permanent in the effort to slash child poverty in Georgia and across America. Over 2 million children in Georgia would benefit from the Expanded CTC. Passing the Working Families Tax Relief Act will help boost Georgia’s economy as more money is put in the hands of middle- and working-class families.

U.S. Senators Tammy Baldwin (D-WI), Richard Blumenthal (D-CT), Maria Cantwell (D-WA), Ben Cardin (D-MD), Bob Casey (D-PA), Chris Coons (D-DE), Catherine Cortez Masto (D-NV), Tammy Duckworth (D-IL), Dianne Feinstein (D-CA), John Fetterman (D-PA), Kirsten Gillibrand (D-NY), Maggie Hassan (D-NH), Martin Heinrich (D-NM), Mazie Hirono (D-HI), Tim Kaine (D-VA), Angus King (I-ME), Amy Klobuchar (D-MN), Ed Markey (D-MA), Jeff Merkley (D-OR), Chris Murphy (D-CT), Patty Murray (D-WA), Gary Peters (D-MI), Jack Reed (D-RI), Jacky Rosen (D-NV), Bernie Sanders (I-VT), Brian Schatz (D-HI), Chuck Schumer (D-NY), Jeanne Shaheen (D-NH), Tina Smith (D-MN), Debbie Stabenow (D-MI), Chris Van Hollen (D-MD), Mark Warner (D-VA), Elizabeth Warren (D-MA), Peter Welch (D-VT), and Sheldon Whitehouse (D-RI) also cosponsored the legislation.

###